Pharmacy Benefit Manager (PBM)

Forensic Audit

Fiduciary Clarity for Employers. Financial Fairness for Pharmacies.

Purpose-Built for Employers and Independent Pharmacies Alike

In partnership with Pharmacy Investigators and Consultants (PIC), our PBM Forensic Audit Platform uses proprietary tools to identify overpayments, missed rebates, and contract inefficiencies in your pharmacy benefit program.

With advanced analytics and machine learning, we uncover hidden savings—especially in complex PBM contracts and high-cost specialty drugs—helping employers recover an average of 10%-20% or more in pharmacy spend.

As a fiduciary under ERISA, you’re required to act in the best interest of your employees. This audit ensures you meet that obligation by driving transparency, compliance, and long-term cost savings.

Significant Cost Savings

Uncover Hidden Fees

Enhanced Transparency

Safeguard Fiduciary Integrity

PBM Accountability Starts Here

This video explores how our platform uncovers hidden costs, missed rebates, and contract manipulation within pharmacy benefit arrangements. Designed for self-insured employers and independent pharmacies, our audit brings transparency, ensures compliance, and helps recover significant pharmacy spend.

Watch to see how our forensic approach can protect your bottom line—and your fiduciary duty.

Safeguarding Fiduciary Integrity in Employer Health Plans

Employers who sponsor self-insured healthcare benefit plans are legally and ethically obligated to act as fiduciaries—placing the best interests of their employees above all else when it comes to managing health plan assets. Nowhere is this duty more critical, or more frequently overlooked, than in the complex world of pharmacy benefit management (PBM).

Our PBM Forensic Audit Platform is designed to help employers fulfill this fiduciary duty by uncovering hidden costs, contract loopholes, and opaque rebate arrangements that often benefit third-party vendors more than the employees they’re supposed to serve. This platform brings clarity and accountability to your PBM arrangement—ensuring your organization is not overpaying for prescription drugs or exposing itself to legal and reputational risks.

Why Fiduciary Oversight Matters

Under the Employee Retirement Income Security Act (ERISA), employers offering self-insured healthcare plans are fiduciaries, meaning they are legally required to act prudently and solely in the interest of plan participants. This includes:

- Ensuring plan costs are reasonable and transparent

- Monitoring third-party administrators and PBM vendors for conflicts of interest

- Regularly auditing plan performance and financial integrity

Failure to meet these responsibilities has led to a growing wave of litigation from employees who claim their employers have mismanaged healthcare benefits—especially in the pharmacy benefit space.

high-profile lawsuits underscore the growing risks:

Real-World Legal Exposure

Johnson & Johnson

Faced a class-action lawsuit alleging that the company overpaid for prescription drugs through its PBM, leading to inflated costs for employees. The lawsuit claimed that J&J paid nearly 500% above pharmacy purchase prices and neglected to audit PBM practices, resulting in higher premiums and out-of-pocket expenses for employees.

Wells Fargo

Accused of mismanaging prescription drug benefits by failing to monitor its PBM effectively, allowing unreasonable drug pricing to persist. The complaint also alleged that consultants retained portions of PBM rebates, contributing to higher costs for plan participants.

JP Morgan Chase

Sued for allegedly mismanaging its employee health and prescription benefits program, resulting in exorbitant prescription drug costs. The lawsuit claimed that JPMorgan failed to monitor and control prescription drug costs, allowing the plan to pay inflated prices, which harmed participants financially.

Increasing Scrutiny and

Legal Risks

These cases underscore the legal risks employers face when they do not adequately oversee their PBM arrangements. Under ERISA, employers have a fiduciary duty to act prudently and solely in the interest of plan participants. Failing to monitor PBM contracts can lead to allegations of fiduciary breaches, resulting in costly litigation and reputational damage.

Importance of Proactive

Oversight

Given the complexity and opacity of PBM operations, it's crucial for employers to proactively manage and audit their PBM relationships. Implementing transparent contracts, regularly reviewing pricing and rebate arrangements, and ensuring alignment with fiduciary duties can help mitigate legal risks and protect plan participants from unnecessary costs.

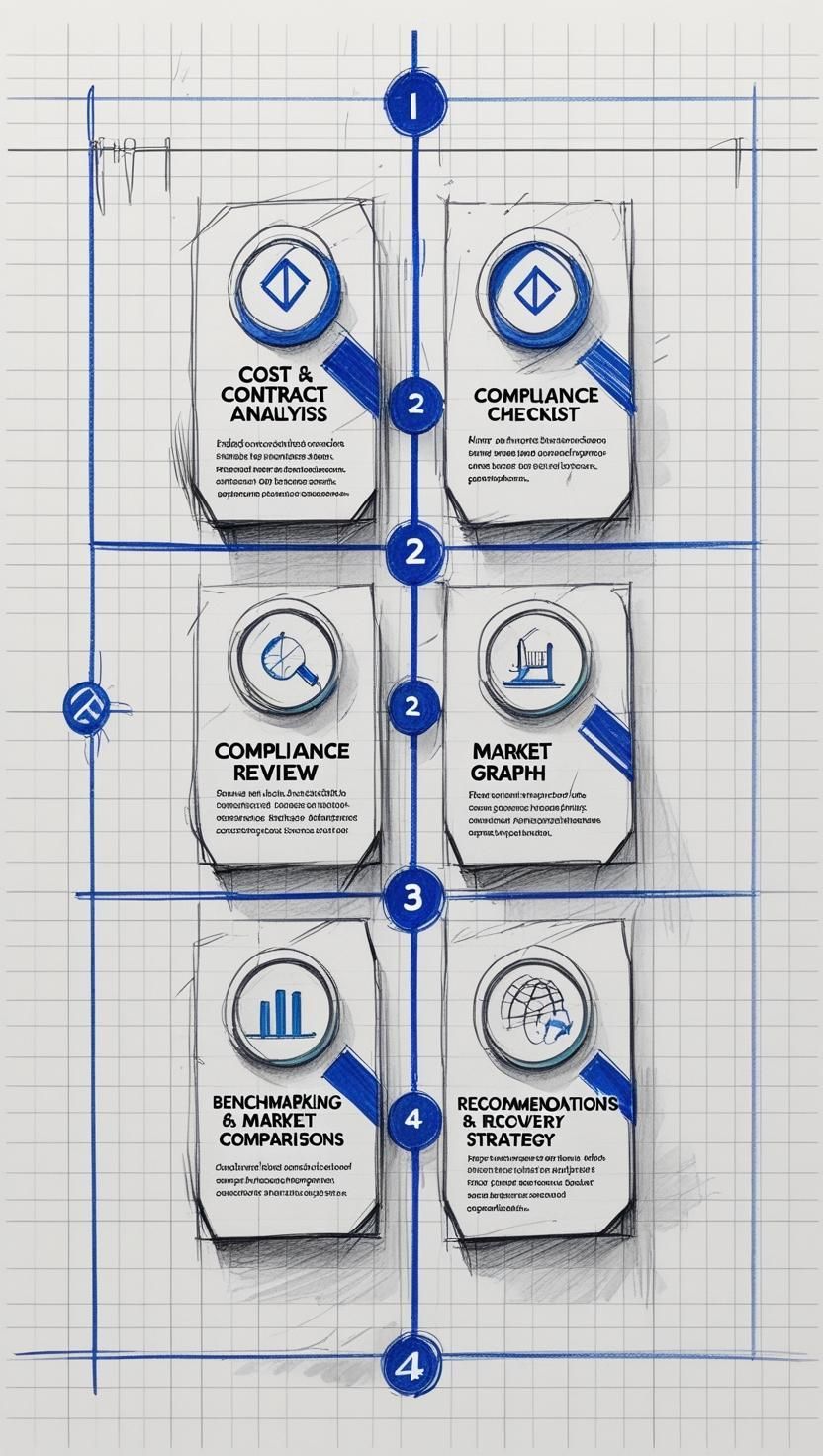

How Our Platform Helps

1.

Detailed Cost and Contract Analysis - We identify inflated pricing, hidden spread margins, and undisclosed rebates.

2.

Compliance Review - We evaluate whether your PBM contract and execution align with fiduciary standards under ERISA.

3.

Benchmarking and Market Comparisons - We compare your plan’s performance against market standards to assess competitiveness.

4.

Recommendations for Recovery and Renegotiation - When overcharges or compliance gaps are found, we guide you through recovery and restructuring.

In an era of increasing regulatory scrutiny and employee activism, employers can no longer afford to take a passive role in PBM oversight. Our platform ensures your organization is not only compliant but also accountable and cost-efficient—demonstrating a clear commitment to fiduciary excellence.

How It Works

01

Send Us Your PBM Contract

Begin by sharing your current PBM contract with us for a full analysis.

02

Direct your PBM to Send Us Your Claim Data

We work with your PBM to obtain claims data, allowing us to thoroughly audit contract adherence and performance.

03

Receive Monthly Monitoring Reports

Each month, you receive detailed reports that highlight areas where savings and recoveries are possible, ensuring transparent tracking and ongoing benefit.

04

Recover Money from Your PBM

Identify recoveries of missed performance, reclaim funds, and optimize future spending.

Report Monitoring Services

Our comprehensive reporting and monitoring provide clients with valuable insights into their PBM programs, including:

- Audit of PBM Performance to Contract Guarantees

We verify adherence to contract terms, such as discounts, dispensing fees, and rebates, ensuring your PBM meets performance guarantees. - Top Costly and Used Brand and Generic Drugs

Identify the most expensive and frequently used medications to optimize formulary design and manage costs effectively. - Top Pharmacies and Patients

Gain insights into high-cost pharmacies and patients to better understand spending trends and opportunities for targeted interventions.

Technology Solutions

Our technology solutions streamline the process, providing clients with easy access to insights and data:

- The Pharmacy Report Card

We provide clients with a monthly report card that includes essential metrics and insights, helping you track performance and savings. - Automated Data Integration

PBMs upload data directly to our secure platform, where reports are generated and sent to clients automatically. - Data Comparison with Contract Terms

Our technology matches claims and data to PBM contract terms, ensuring continuous oversight and recovery of missed savings.

Support for Independent Pharmacies

Protecting Margins. Strengthening Leverage. Preserving Trust.

Independent pharmacies are the front lines of patient care—but too often, they’re the last to know when shrinking margins, unfair reimbursement rates, or PBM contract discrepancies are quietly undermining their revenue.

Our PBM Forensic Audit Platform isn’t just for employers. We offer tailored support for independent pharmacies—empowering you with the same level of transparency, oversight, and data-driven intelligence used by large employer-sponsored plans.

How We Help Independent Pharmacies

Our audit and monitoring platform delivers ongoing visibility into how PBMs are affecting your bottom line. Whether you're part of a PSAO or operating independently, we provide tools that allow you to take back control.

🔍 Margin Tracking & Reimbursement

- Compare reimbursement amounts to NADAC pricing or your actual drug acquisition costs

- See real-time margin performance by PBM, drug, and location

- Identify drugs where reimbursement falls below cost—giving you clear, defensible data to renegotiate or push back

📄 Contract Compliance & PSAO Oversight

- Audit PBM performance against your PSAO agreements

- Ensure PBMs are meeting performance guarantees and not quietly skimming margins

- Discover discrepancies that may be costing you thousands per quarter

🚨 FWA (Fraud, Waste & Abuse) Claim Scoring

- Identify claims that may trigger PBM red-flag alerts—before you get penalized

- Avoid getting caught in the middle of questionable prescribing behavior (e.g., ivermectin for COVID or off-label ketamine scripts)

- Maintain good standing with PBMs and plan sponsors by proactively flagging high-risk claims

Why It Matters

PBMs have powerful systems to monitor your performance. Isn’t it time you had one of your own?

With our platform, you gain:

- Leverage in negotiations

- Evidence to challenge unfair reimbursements

- Protection against clawbacks and compliance violations

FEE STRUCTURE:

A Financially De-Risked Model

At CG Moneta Consulting, our PBM Forensic Audit Platform is designed not only to uncover hidden value but to do so in a way that protects your organization from financial risk.

We operate under a modified contingency fee model, structured to ensure alignment, transparency, and measurable return on investment.

01

Initial Complimentary Analysis

We begin with a no-cost preliminary assessment to determine the presence and magnitude of recoverable revenue from underpayments, contract misalignments, or pricing variances.

02

Implementation Fee - After Opportunity is Identified

If our initial analysis indicates substantial financial recovery, we proceed with a one-time implementation fee. This covers the full activation of our audit platform, data integration, and deployment of our clinical and contractual analytics teams.

03

100% Recovery Retained by You — Until Break-Even

To ensure complete financial protection, you retain 100% of all recovered revenue until your organization has fully recouped the implementation cost.

04

Contingency Model After Cost Recovery

Once the implementation cost has been recovered, we transition to a performance-based model. From that point forward:

- You retain 70% of all additional recovered revenue

- CG Moneta Consulting receives a 30% contingency fee

This approach financially de-risks the platform, ensuring that your organization can engage confidently — with no upfront investment unless clear value is demonstrated.