R&D Tax Credit

Reduce Federal and State Tax Liability

Request Feasibility Analysis

Request Feasibility Analysis

What is the Research and Development Tax Credit?

The Research and Development (R&D) Tax Credit is a tax incentive provided by governments to encourage businesses to invest in innovation and technological advancement. It allows eligible businesses to claim a credit against their taxes based on qualified research expenses incurred during the development or improvement of products, processes, software, formulas, techniques, or inventions. The R&D Tax Credit aims to stimulate economic growth by incentivizing companies to undertake research activities that drive innovation, improve competitiveness, and contribute to overall technological progress. This credit can significantly reduce a company's tax liability, providing valuable financial resources to further invest in research and development initiatives.

What are the benefits of the R&D Tax Credit?

The Research and Development (R&D) Tax Credit offers several key benefits to eligible businesses:

- Financial Incentive: The R&D Tax Credit provides a direct financial incentive for companies to invest in research and development activities. By reducing the tax liability of businesses, the credit frees up resources that can be reinvested into further innovation efforts.

- Cost Reduction: The credit effectively lowers the after-tax cost of conducting research and development. This can make R&D projects more financially feasible for businesses, particularly startups and small to medium-sized enterprises (SMEs) with limited resources.

- Promotes Innovation: By rewarding companies for engaging in research activities, the R&D Tax Credit encourages a culture of innovation. Businesses are more likely to invest in exploring new technologies, developing innovative products, and improving existing processes to stay competitive in their industries.

- Job Creation and Economic Growth: Increased investment in R&D can lead to job creation and economic growth. Companies that take advantage of the R&D Tax Credit may expand their research teams, hire skilled workers, and invest in infrastructure, contributing to overall economic prosperity.

- Supports Various Industries: The R&D Tax Credit is available to businesses across a wide range of industries, including manufacturing, technology, pharmaceuticals, biotechnology, software development, and more. This broad eligibility promotes innovation across diverse sectors of the economy.

Overall, the R&D Tax Credit serves as a powerful tool for driving innovation, fostering economic growth, and maintaining global competitiveness for businesses and economies alike.

How to claim the R&D Tax Credit

Identify Eligible Activites

The first step is to identify the research and development activities that qualify for the R&D Tax Credit. These activities typically involve the development or improvement of products, processes, software, formulas, techniques, or inventions. Qualified activities must meet specific criteria defined by the tax authorities, such as being technological in nature, involving a process of experimentation, and intended to eliminate uncertainty regarding product or process development.

Document Qualified Expenses

Businesses need to document their qualified research expenses, including wages paid to employees directly involved in R&D activities, supplies used in R&D, and expenses related to contract research conducted by third parties. It's crucial to maintain detailed records and documentation to support the claim for the R&D Tax Credit.

Calculate the Credit

Once eligible activities and expenses have been identified and documented, the next step is to calculate the R&D Tax Credit. The credit is typically calculated as a percentage of qualified research expenses incurred during the tax year. The exact calculation method may vary depending on the jurisdiction and specific regulations governing the credit.

Include the Credit on Tax Return

Businesses must include the R&D Tax Credit on their tax return for the appropriate tax year. This often involves completing specific forms or schedules provided by the tax authorities, such as Form 6765 (Credit for Increasing Research Activities) in the United States. The credit is then applied to reduce the company's tax liability for the tax year in which the qualified expenses were incurred.

Supporting Documentation and Audit Defense

It's essential for businesses to retain supporting documentation and records to substantiate their R&D Tax Credit claim. In the event of an audit or review by tax authorities, having thorough documentation can help defend the claim and ensure compliance with applicable regulations.

Consult with Tax Professionals

Given the complexity of the R&D Tax Credit and the potential for significant tax savings, businesses often seek guidance from tax professionals or specialists with expertise in this area. Tax professionals can provide valuable advice on eligibility criteria, documentation requirements, credit calculation methods, and compliance with tax regulations.

Eligible Industries

- Aerospace

- Architecture & Engineering

- Blockchain Development

- Chemical

- Construction/MEP

- Consumer Products

- Contract Manufacturing

- Financial Services

- Food & Beverage

- Game Development

- Manufacturing

- Metal Fabrication

- Mortgage & Banking

- Oil and Gas

- Pharma

- Plastics/Injection Molding

- Software Development

- Tool & Die

Qualifying Expenditures for the Tax Credit

- Wages and Salaries: Salaries, wages, and bonuses paid to employees directly involved in performing or supervising qualified research activities are eligible for the R&D Tax Credit. This includes scientists, researchers, engineers, technicians, and other support personnel directly engaged in R&D efforts.

- Contract Research Expenses: Costs incurred for contract research conducted by third-party vendors, universities, or research institutions can qualify for the R&D Tax Credit. Businesses may contract with outside experts to perform specialized research or to supplement in-house R&D capabilities.

- Supplies and Materials: Expenses for supplies, materials, and equipment used in the conduct of qualified research activities are eligible for the R&D Tax Credit. This includes items such as laboratory supplies, prototype materials, computer software, and testing equipment directly related to R&D projects.

- Prototyping and Testing Costs: Costs associated with prototyping, testing, and experimentation are eligible for the R&D Tax Credit. This includes expenses for building and testing prototypes, conducting feasibility studies, and analyzing data to evaluate the technical feasibility of new products or processes.

- Overhead and Indirect Costs: Certain indirect costs associated with qualified research activities may also qualify for the R&D Tax Credit. This can include a portion of overhead expenses such as utilities, rent, depreciation, and other indirect costs allocable to R&D projects.

- Qualified Research Services: Payments made to outside consultants, research firms, or technical experts for qualified research services may be eligible for the R&D Tax Credit. These services could include design, engineering, testing, or other specialized technical services directly related to R&D projects.

- Software Development Costs: Expenses related to the development or improvement of software that constitutes qualified research may be eligible for the R&D Tax Credit. This includes costs for software development tools, programming, debugging, and testing activities undertaken to advance technological knowledge or capabilities.

Examples of Qualified Research Activities

- Development of New Products: Designing and developing new products, including prototypes and models, that involve significant technical uncertainty or require experimentation to overcome technological challenges.

- Improvement of Existing Products: Conduct research to enhance the performance, functionality, or reliability of existing products through innovative design changes, material improvements, or technological advancements.

- Software Development: Developing or improving software, including coding, testing, and debugging activities, to create innovative solutions, enhance user experience, or optimize system performance.

- Process Optimization: Researching and experimenting with new manufacturing processes, production methods, or operational techniques to increase efficiency, reduce waste, or improve quality standards.

- Formulation and Testing: Experimenting with new formulations, chemical compositions, or materials to develop improved products, such as pharmaceuticals, cosmetics, or specialty chemicals, and conducting testing to assess their efficacy and safety.

- Prototyping and Modeling: Building and testing prototypes, models, or proof-of-concept designs to evaluate feasibility, functionality, and performance characteristics of new products or technologies.

- Engineering and Design Activities: Engaging in engineering and design activities to address technical challenges, solve complex problems, or develop innovative solutions for specific industry applications.

- Biotechnological Research: Conducting research in biotechnology, genetics, or life sciences to develop new drugs, therapies, medical devices, or diagnostic tools aimed at improving human health and well-being.

- Environmental Research: Investigating innovative solutions for environmental conservation, pollution prevention, or sustainable energy development, including renewable energy technologies and clean manufacturing processes.

- Aerospace and Defense Innovation: Researching and developing advanced aerospace, defense, and aviation technologies, including aircraft design, propulsion systems, avionics, and military equipment.

Alternative Minimum Tax Liability

The Protecting Americans from Tax Hikes (PATH) Act of 2015 introduced provisions enabling small and mid-sized taxpayers to offset their Alternative Minimum Tax (AMT) liability with the Research and Development (R&D) tax credit, effective for taxable years commencing on or after January 1, 2016.

Previously, qualified companies faced limitations due to AMT, preventing them from fully utilizing the R&D tax credit. Any surplus credits were required to be carried back and then forward. However, the PATH Act removes this hindrance for small businesses, allowing them to offset their Alternative Minimum Tax through the R&D tax credit. Therefore, for tax years starting after December 31, 2015, there is no longer any restriction.

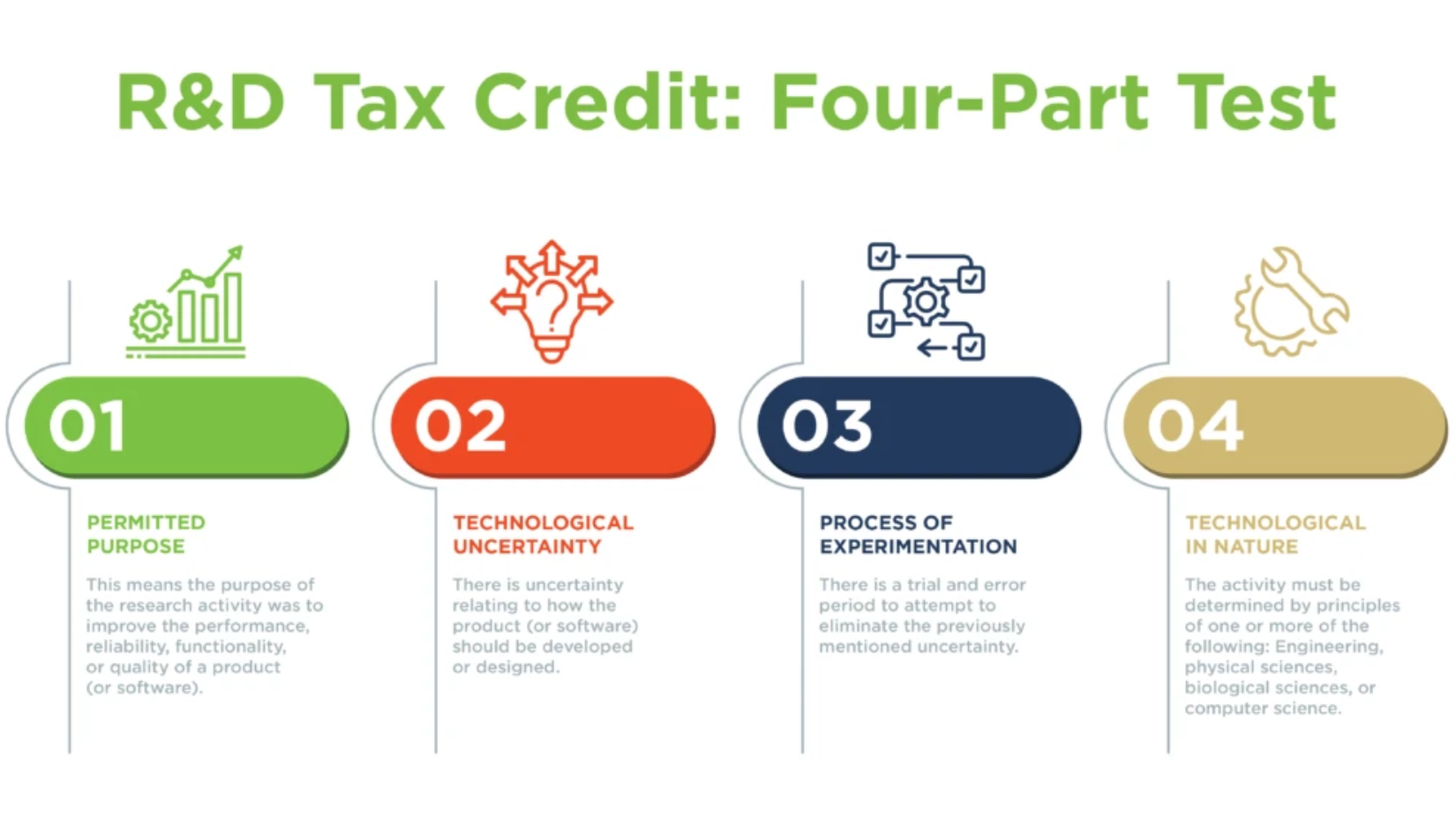

Four Part Test

Thorough documentation is paramount in substantiating R&D tax credit claims. This entails demonstrating a valid purpose, technological uncertainty, adherence to a systematic process of experimentation, and alignment with technological objectives.

Specialized Tax Incentives

CG Moneta Consulting offers an array of specialized tax incentive services that align with the leading firms nationwide, ensuring comprehensive support and significant benefits for businesses across all industries and sizes. Our team combines expertise, industry knowledge, and innovative strategies to deliver tailored solutions that optimize tax incentives and maximize savings. Whether it's Cost Segregation, Research & Development Tax Credits, Energy Efficiency Deductions, or other specialized incentives, we provide thorough analysis, meticulous documentation, and strategic guidance to help businesses unlock their full tax-saving potential. With a commitment to excellence and a focus on client success, CG Moneta Consulting stands as a trusted partner for businesses seeking to navigate the complex landscape of tax incentives and realize substantial financial benefits.